Polkadot Deep Dive

H1 2022

H1 2022

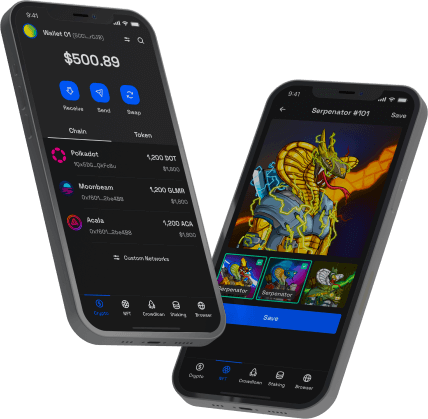

Ever since its launch in May 2️⃣ 0️⃣ 2️⃣ 0️⃣ following the successful launching of its canary network Kusama in 2019, Polkadot has attracted rapt attention from the media, crypto users and venture capitals. Though bustling with development activities, the Polkadot ecosystem often faces complaints and suspicions due to data fragmentation that poses much difficulty for users to keep track. In order to provide a panoramic view of and give detailed insights into the states of both Polkadot and Kusama, SubWallet is compiling data scattered around various sources to present this Polkadot Deep Dive quarterly report. In this inaugural edition, we look into the overall ecosystem growth in the first half of 2022, with sections focused on DeFi, NFT and Web3.

In H1 2022, the crypto market entered what was known as one of the worst crypto winters that threatened to drive many out of business. After hitting the all-time high of $55.00 with a $53.21B market cap around the time of the first parachain auction in early May 2021, DOT followed a drastic downturn path, going as low as $6.43 at $6.90B market cap on June 13, a month after the unprecedented meteoric LUNA/UST crash. The DOT market cap had gone down 75.03% since the year started, from $26.43B to $6.60B. KSM price and market cap more or less shared the same pattern.

*Only DeFi parachains are discussed here. For analyses of DApps, please scroll down to the next sections.

Overall, DeFi activities were higher in Q1 compared to Q2, partly because token prices all declined in the bear market. Polkadot DeFi parachains far outweighed those on Kusama in terms of total value locked (TVL), with two leading representatives Acala and Parallel both oscillating around $500M during H1. Though began much later than Parallel, Acala got off on the right foot with an average of 15% higher in TVL compared to Parallel in the first two months, peaking at $767.30M, only to lose their lead by 20% on average in the remaining part of H1. Parallel took the opportunity to rise up as the reigning protocol in terms of TVL, even though this is a hard-to-confirm conclusion due to inconsistencies in data reporting between Defi Llama and Parallel Analytics.

At its peak, aUSD issuance on both Acala and Karura totaled $14.98M on May 7, before quickly plunging and arriving at $4.33M on Acala and $3.77M on Karura, adding up to $8.10M by the end of June.

This near halving in total supply is nowhere near attractive; instead, aUSD risks losing its leading position to AstridDAO's BAI, another native multi-collateral stablecoin developed on Astar Network, whose circulation oscillated around $5M at the end of H1.

| NFT Collection | Volume (KSM) | Transactions |

|---|---|---|

| KANBIRD | 34,518.13 | 1146 |

| KANBG | 3,040.60 | 392 |

| KQ01 | 2,831.00 | 78 |

| RMRK profile banners | 2,346.43 | 2252 |

| Kusama Kings | 1,554.27 | 26 |

| EVRLOOT_TAROT_CA... | 1,149.23 | 400 |

| KANPRTN | 1,128.78 | 367 |

The growth of these DApps are promising for the tipping point of Polkadot, because they will be the core actors that attract end-users to the ecosystem. It's a win-win situation after all: wherever users go, resources will follow. Tether will surely increase its USDT supply on Polkadot if the user base is tripled. More EVM multi-chain projects will jump in, and everyone gains benefits.

At that point, data will have to be reported in a precise and sufficient manner, ideally by a third party. While collecting data, we encountered several cases of data defects that could have been remedied if more attention had been paid. Because data speaks volumes about the development of an ecosystem, it is of major importance that both project teams and data aggregator platforms make sure that the recording and reporting are correct.